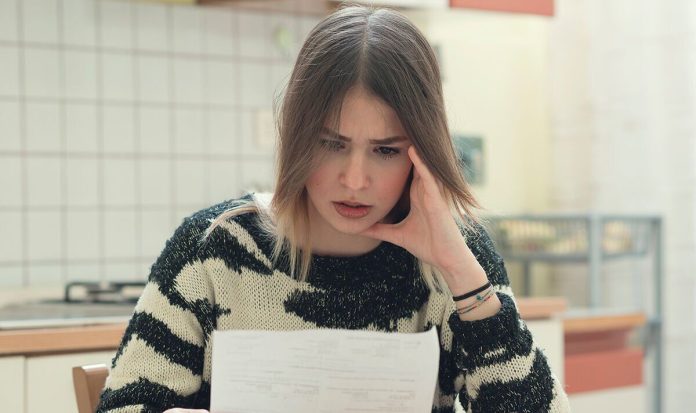

A woman has pledged to check her tax code every month after she was put on the wrong code and overcharged £400.

Martina Brannigan was put on the wrong tax code after starting a new job and paid too much tax, forcing her to dip into her savings to get by, reports The Sun.

A person’s tax code determines how much income tax is deducted from their earnings. An individual can find theirs on a recent payslip, or on their personal tax account on the Government website.

Ms Brannigan, from Newcastle, started a new job in finance in December. When she got her payslip for the new job, she saw her wages had gone down by £400 compared to the previous month.

She checked her tax code and noticed it included the letters ‘BR’. This stands for ‘basic rate’ and means a person pays the basic rate of 20 percent on all their earnings, and does not get a Personal Allowance, an amount they can earn each year without paying tax.

READ MORE: How to check your tax code and what they mean for how much income tax you pay

She was given this code because she was paid some accrued holiday pay from her previous job in February, and this payment made it seem she was working two jobs at the same time.

She said it was a “nightmare” as she was short on covering her bills for two months as a result.

She had to take out £2,000 from her savings to get by and spend on her credit card to cover the costs for petrol and food.

Fortunately, she flagged up the issue with HMRC using her Government Gateway account and at the start of April, she received a letter with a new tax code and a £400 refund.

A person with a single source of earnings will usually start with their Personal Allowance of £12,570 and this will be adjusted depending on any employee benefits they receive.

The most common tax code is 1257L, meaning a person has the standard Personal Allowance, which is £12,570.

A person can check how much tax they should be paying for the current year on the Government website using their Government Gateway account.

Individuals can use the service to:

- Check tax code and Personal Allowance

- See estimated income from jobs and pensions and the tax people can expect to pay for the current tax year

- Update details of income from jobs and pensions – as people may pay too much or too little tax if not up to date

- See if a tax code has changed

- Tell HMRC about changes impacting a tax code

- Update their employer or pension provider details.

For the latest personal finance news, follow us on Twitter at @ExpressMoney_.

Source: Expressnews.co.uk